Start-ups

There is a favourable trend in Luxembourg for the development of start-ups, particularly innovative firms in the domains of Fintech and IT, but also in robotics, artificial intelligence, gaming and biotech.

The community is very active and benefits from the support of public, para-public or private organisations.

Many initiatives and solutions have been set up to help innovative entrepreneurs to start their business and then grow globally.

Description

Starting a business in Luxembourg

There is a favourable trend in Luxembourg for the development of start-ups, particularly innovative firms in the domains of Fintech and IT, but also in robotics, artificial intelligence, gaming and biotech.

The community is very active and benefits from the support of public, para-public or private organisations.

Many initiatives and solutions have been set up to help innovative entrepreneurs to start their business and then grow globally.

Start-ups in Luxembourg

Luxembourg is a very attractive place for start-up companies and innovative companies. Such firms can benefit from:

- an active start-up community,

- the presence of several incubator and accelerator programmes all over the country, often supported by the government

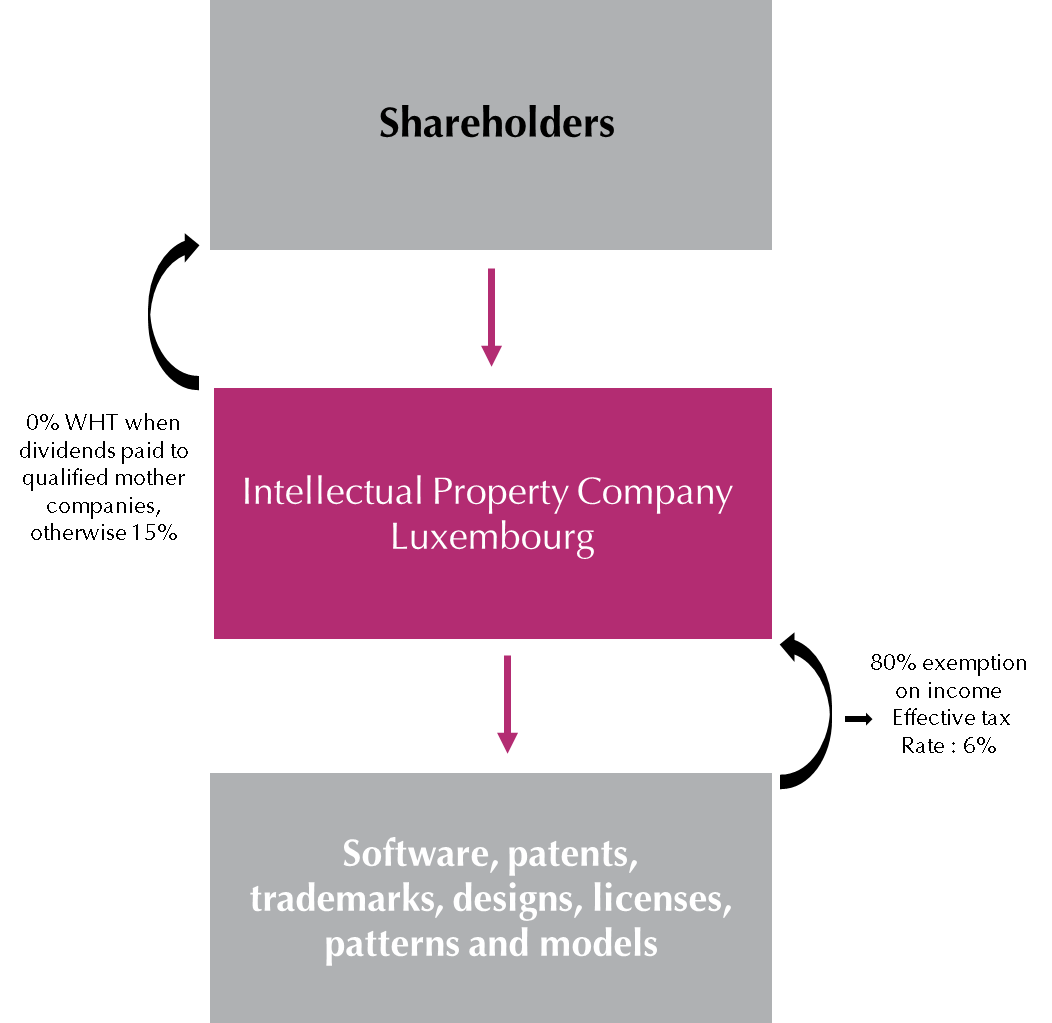

- the favourable tax regime and, in particular, an interesting IP tax regime. Plus Luxembourg has the lowest VAT rate in Europe

- public or para-public subventions and grants (eg. Luxinnovation)

Luxembourg Business Angels and Venture Capitalists

However, start-up companies may need more than the above noted measures and finding investors will be necessary. This can be achieved with the help of:

- “Business Angels” – high net worth individual investors who seek high returns through investment of a share of their assets in an innovative and high potential company. Usually, these former entrepreneurs or executives also offer access to their competencies, experience, networks and time.

- “Venture Capital Investors” – investment firms which inject capital, in cash, in exchange for shares and an active role in the invested company (board participation, strategic marketing, governance, structure, etc). They have a long term strategy allowing companies the time to mature into profitable organisations. Generally, they have a limited operating time and their aim is to achieve a good rate of return; so, they have an exit strategy plan as well.

Raising Capital via Luxembourg

Luxembourg offers a wide range of solutions to allow entrepreneurs to structure their capital raising activity. Funds, both public and private placement funds, can provide interesting solutions – from venture capital, over private equity to listed equity investments. Corporations, promoters and entrepreneurs also use the holding structure in Luxembourg, the SOPARFI, to pool their equity participations and finance companies. The SLP (Special Limited Partnership) can also be considered when starting a business.