Investment Fund Set-Up

The Luxembourg investment fund industry is largely benefiting from its location in a strong financial centre. The country is now an internationally recognised label for investment funds. The greatest asset of Luxembourg is a constant anticipation of the needs of investors in order to create a stable, protective, and favorable environment according to the expected development of the market.

Description

The Luxembourg investment fund industry is largely benefiting from its location in a strong financial centre. The country is now an internationally recognised label for investment funds. The greatest asset of Luxembourg is a constant anticipation of the needs of investors in order to create a stable, protective, and favorable environment according to the expected development of the market.

Legal and regulatory framework

The promoters of investment vehicles have now the choices among these categories of Luxembourg based investment funds when they consider to incorporate their funds:

- Undertakings for Collective Investment in Transferable Securities (UCITS, +/- 46 as at June 2017);

- Undertakings for Collective Investment (Sicav Part II, +/- 165 as at June 2017);

- Specialised Investment Funds (SIF, +/- 1600 as at June 2017);

- Capital Risk Investment Company (SICAR, +/- 280 as at June 2017);

- Securitisation Undertakings ( S.V., +/- 1500 as at June 2017);

- Reserved Alternative Investment Funds (RAIF +/- 100 – www.raif-luxembourg.com);

- Common Alternative Investment Fund (SLP)

Gearup Solutions advises promoters, investors, fund managers throughout the fund creation process in order to take advantages of the Luxembourg favourable regulatory framework and taking into account the level of regulation applicable to each specific cases.

Before any incorporation of a fund, it is important to assess the needs of the investors and select the right level of regulatory framework.

Some funds are highly regulated like the UCITS and some funds are not regulated like the RAIF and the SLP. Some can invest into Alternative Investment Fund and others cannot. While some funds have no risk spreading rule some other might be limited.

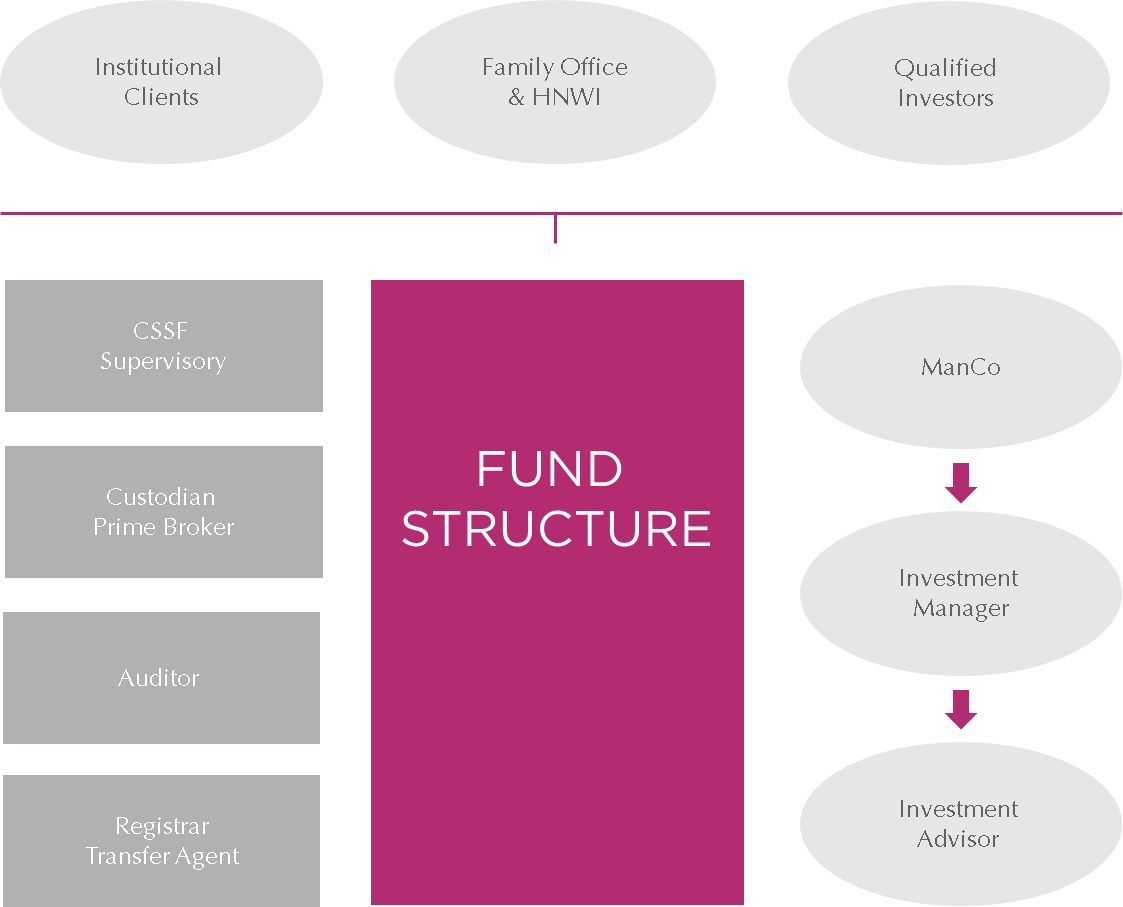

Not every investor can invest in one or another vehicle. Therefore it is important to choose the one which will be adapted to the type of investors.

Once such choices are made, the promoter will select the right form of entity to incorporate his fund. Some funds can be formed in contractual form and consequently as an Investment Fund represented by a Managing Company (fonds commun de placement, (FCP) or in the form of a company, namely as an Investment Company whose capital is variable (SICAV) or fixed (SICAR).

The SICAV can be formed as a company, as a Public Limited Company (PLC., Corp./SA); a Limited Liability Company (LLC., Ltd./SARL); a Partnership Limited by Shares (SCA) or as Co-operative in the form of a Public Limited Company (CoopSA). A Sicav in Luxembourg may take the structure of a Holding Fund constituted by several sub-funds, each of which are independent of the others.

Some Investment Fund can be incorporated as a Special Limited Partnership.

Depending on their assets under management the Manager does not need to be regulated (less of 100 Mio or less of 500 Mio for closed end funds). All of these choices taken at incorporation will dictate how the funds or its manager will be able to distribute it and market it.

How much does it costs to incorporate and run a Luxembourg Fund?

Depending on all of these criteria, the incorporation of a Luxembourg Investment Fund can start as low as 25 000 Eur. The Running costs start from 20 000 Eur a year and will evolve with the asset under management, the custody, the audit, the marketing, the reporting, etc.

Gearup Solutions services include:

- Advisory upon Incorporation

- Drafting or Review of the fund documentation

- Coordination between the service providers

- Central Administration for alternative investment vehicles

Would you like further information, Do you have any requests ? Click here